do nonprofits pay taxes on lottery winnings

Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. All winnings from the lottery are subject to tax but its not as simple as paying for it the year you won.

Best Ways Lotto Winners Have Donated Their Prize Lottery Blog

Lottery winnings are considered ordinary taxable income for both federal and state tax purposes.

. If you take its annuity value youll have to pay taxes every year. The key to avoiding income taxes is to give the ticket or an interest in the ticket to the charity before the drawing and before you are entitled to the winnings. When the lottery winner does reside in a specific state then most of the states in the USA do not withhold lottery tax by state.

Theyre imposed on earned income so heres the good news. We never bill hourly unlike brick-and-mortar CPAs. The IRS takes 25 percent of lottery winnings from the start.

Enjoy flat rates with no-surprises. Section 671b of the Tax Law and Section 11-1771b. These yearly payments will count as taxable income at both the federal and.

Although winning from lotteries is part of total income the same taxable at 30 Surcharge health and education cess as per. Only two states out of the 43 states that. Most states dont withhold taxes when the winner doesnt reside there.

If youre a UK tax resident youre exempt from paying the following taxes on your lottery winnings. Yes nonprofits must pay federal and state payroll taxes. As soon as you have.

Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. However just like American players youll be expected to pay taxes when you win. FICA taxesSocial Security and Medicareare employment taxes.

Lottery winnings are exempt from FICA taxes because. The amount deducted from your prize will depend on the state where your ticket was purchased and the. In fact of the 43 states that participate in multistate lotteries only two withhold taxes from nonresidents.

Do nonprofits pay payroll taxes. Yes they have to pay tax on lottery winning. If you are sharing your winnings.

Enjoy flat rates with no-surprises. So even if you. You might not realize it but if you win the lottery you wont be handed a check for the full amount.

Your recognition as a 501c3 organization exempts you from federal income tax. We never bill hourly unlike brick-and-mortar CPAs. The proper thing to do here would be to immediately form a charity 501c3 nonprofit organization dedicated to supporting the poor and give the lottery winnings directly to that.

Winnings are taxed the same as wages or salaries are and the total amount the winner. Depending on the state you live in you may have to pay state and local taxes on lottery winnings in addition to federal taxes. It is possible to donate to a non-profit organization that enables you to maximize some itemized deductions which could bring you into a lesser tax bracket.

The only time you pay taxes on lottery winnings every year is if youve chosen the annuity payment option. Federal tax To begin with lottery agencies have to withhold 24 of. The nonprofit doesnt have to pay tax on either lottery winnings that it paid for or on contributions from the Pool members.

Phew that was easy.

Preparing A Client To Claim A Lottery Jackpot Wsj

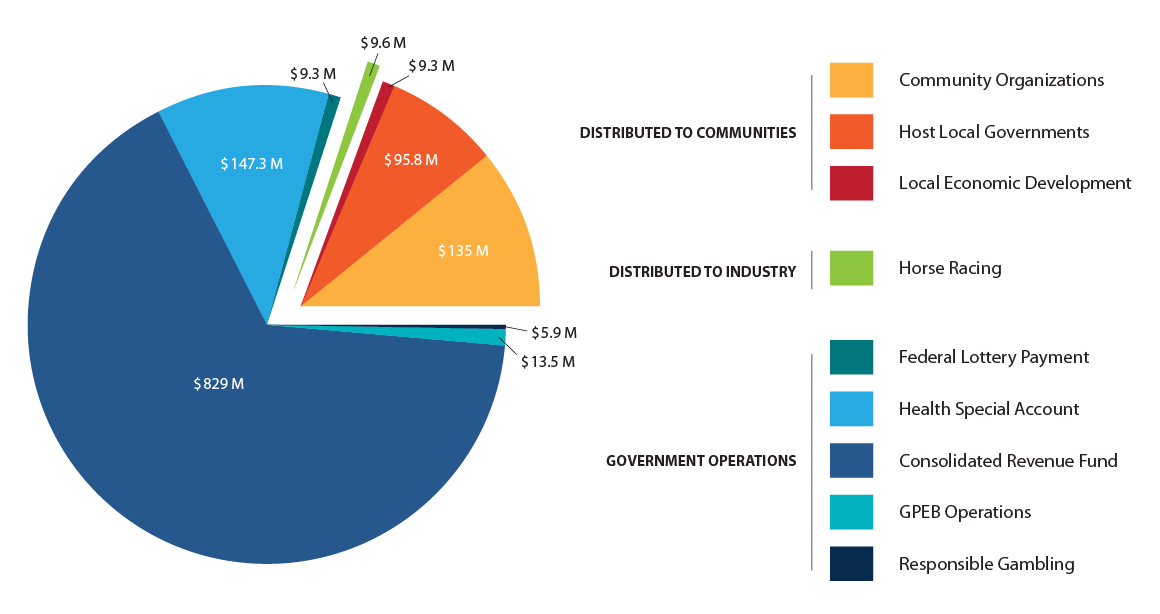

Gambling Revenue Distribution Province Of British Columbia

Lottery Winners Online Share The Dark Side Of Winning The Jackpot

You Won The Lottery Here S What You Should Do Now Gordon Fischer Law Firm

What Other Countries In This World Doesn T Tax Lottery Winnings Until You Earn Interest Other Than Australia Quora

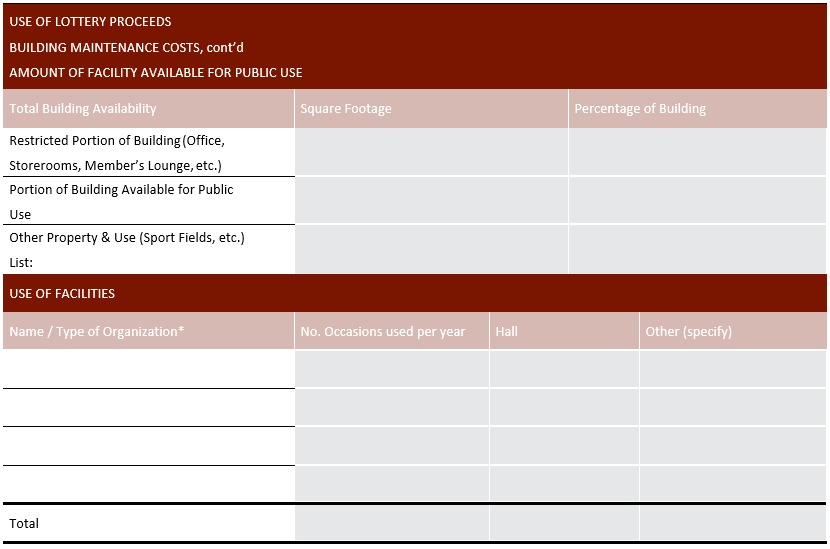

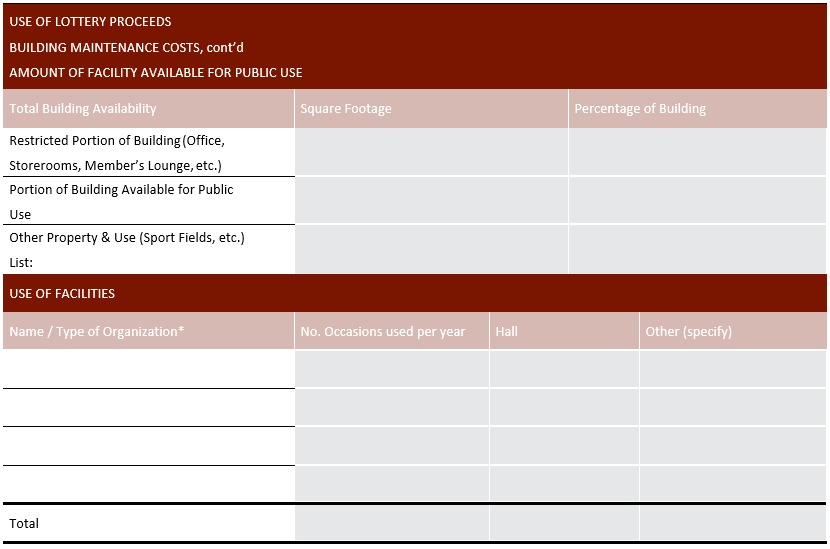

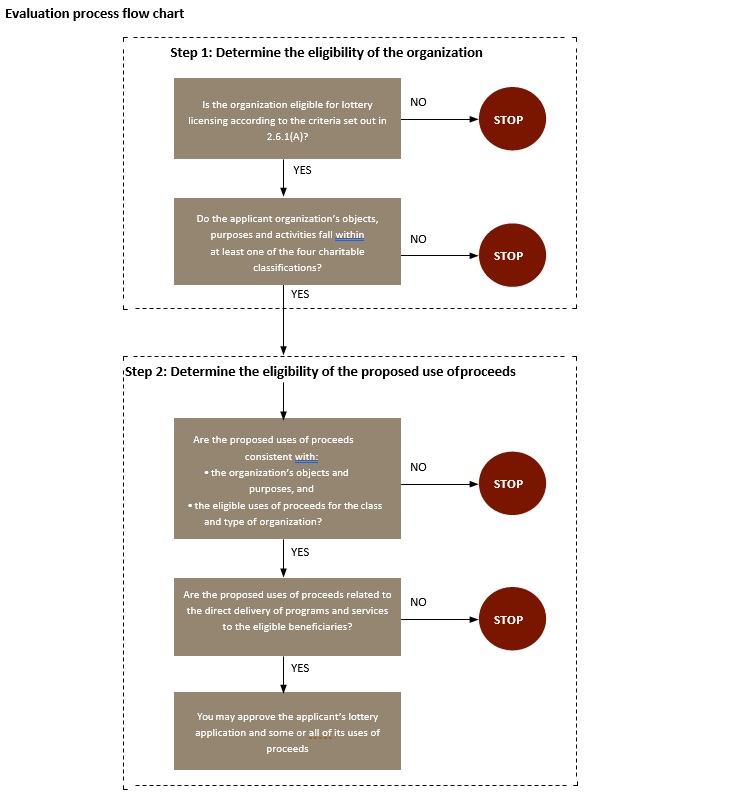

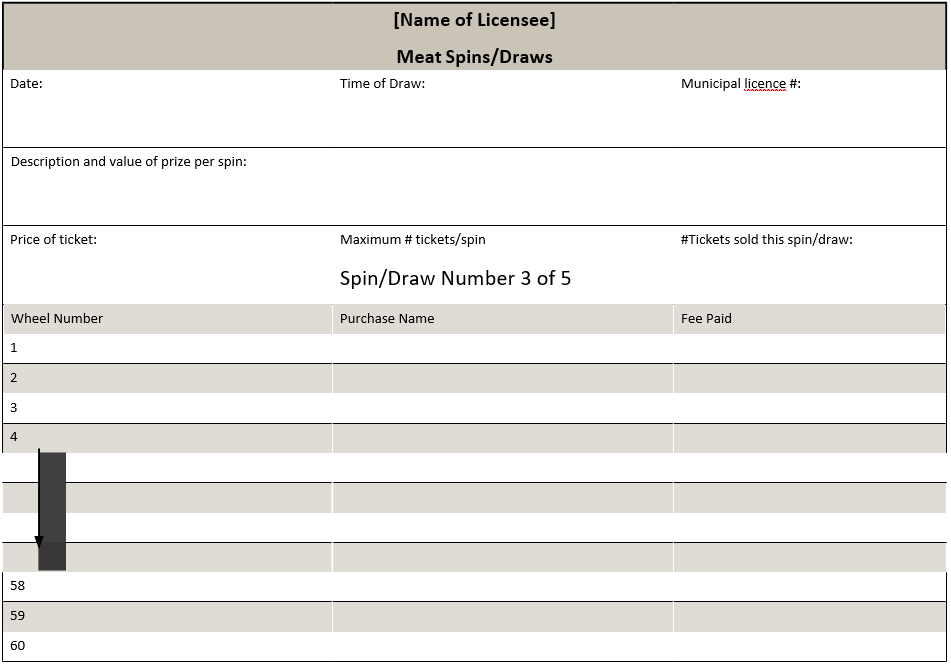

Lottery Licensing Policy Manual

Guy Wins 40 Million Dollars In The Lottery Donates All To Charity R News

/cdn.vox-cdn.com/uploads/chorus_asset/file/5902101/shutterstock_254400031.0.jpg)

Lottery Winners Should Start A Private Foundation No Really Vox

Some Insight Into Lottery And Gambling Taxes Powerball Lotto Tickets Winning The Lottery

The 560 Million Secret Behind This Lottery Ticket

Editorial Keep Lottery Winners Names Public The Daily Gazette

Powerball Winner Collects Prize Could Still Lose Anonymity The Two Way Npr

Lottery Licensing Policy Manual

50 Grand Winning Lottery Ticket From Food Store In Hamilton Nj

The Top 12 Biggest Jackpot Winners Of All Time

How To Increase Your Odds Of Winning The Lottery Rockypointautoinsurance

13 I 16 In 2022 Winning Powerball Lucky Numbers For Lottery Winning Lottery Numbers

Lottery Licensing Policy Manual

Monday Map State Local Taxes Fees On Wireless Service Online Lottery Lottery Infographic Map